32+ payroll tax calculator maryland

Gross income Retirement contributions Adjusted gross. If you make 70000 a year living in Maryland you will be taxed 11177.

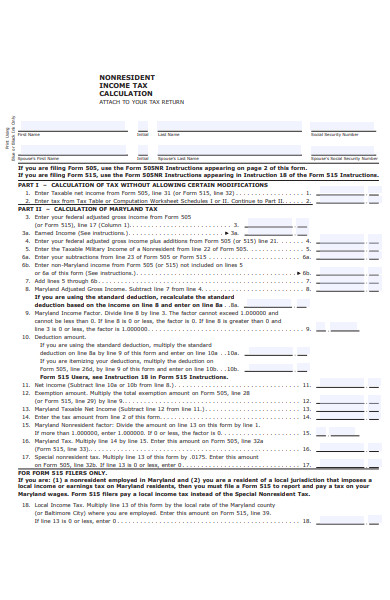

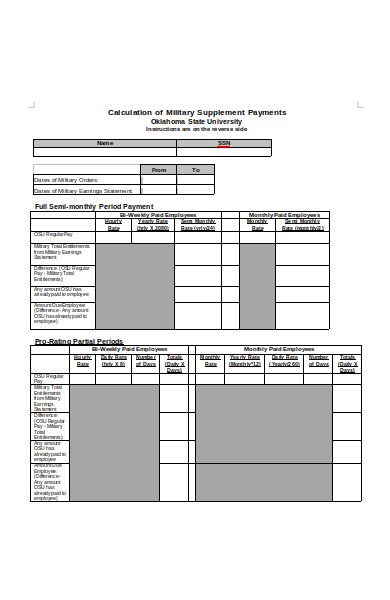

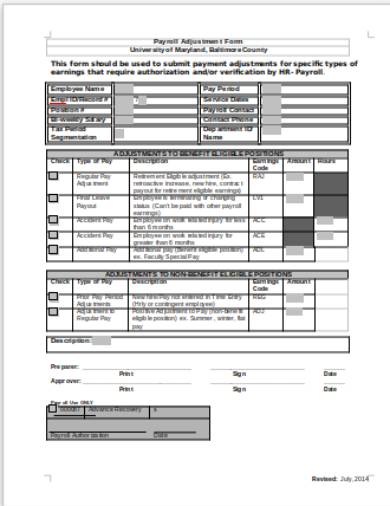

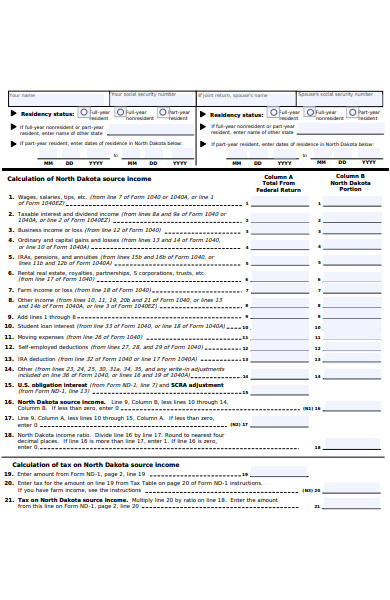

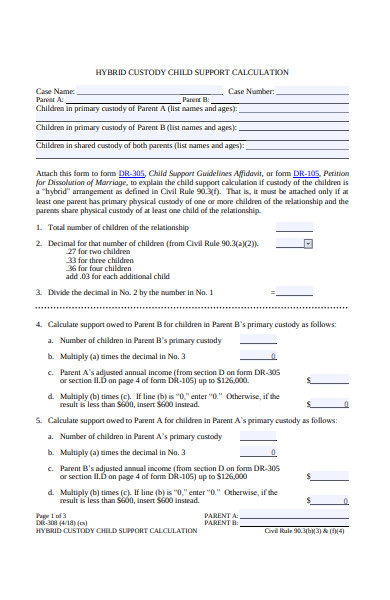

Free 31 Calculation Forms In Pdf Ms Word

New employers will pay a 23 tax rate and established employers pay rates.

. Ad Compare This Years Top 5 Free Payroll Software. Free Unbiased Reviews Top Picks. Add W-2 employees at any time.

This unemployment tax is charged on the first 8500 of each employees wages each year. Boost Your Business Productivity With The Latest Simple Smart Payroll Systems. Web Maryland Income Tax Calculator 2022-2023.

Web The net pay calculator can be used for estimating taxes and net pay. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Get 3 Months Free Payroll.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Web Employer taxes are calculated using a number of variables including the type of tax the employees wages or salary and the employers payroll tax rate.

Web Maryland Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state. Web PAYCHECK CALCULATOR You can use our Maryland Check Stub Maker to compute salaries whether they are hourly or weekly. Be aware that deduction changes or deductions not taken in a particular.

Determine your filing status. Web Maryland changes employers a tax to provide benefits to unemployed workers. Web Calculate your Maryland state income tax with the following six steps.

Web Maryland Income Tax Calculator - SmartAsset Find out how much youll pay in Maryland state income taxes given your annual income. Plus employees also have to take local. We have several formats and paystub styles.

All-In-One Payroll Solutions Designed To Help Your Company Grow. Compare Side-by-Side And Find The Best Payroll For Your Business. Web This net pay calculator can be used for estimating taxes and net pay.

This is only an approximation. 2023 ERC Program Eligibiliity Verification - Get Up to 26k Per Eligible Employee. Get Started For Free.

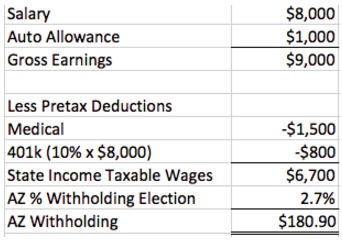

Tax rates range from 2 to 575. Statewide rate between 2-575 depending on income plus a flat county or city tax rate of 225-32 depending. Web Maryland Payroll Taxes.

Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds. Web Marylands unemployment tax is charged on the first 8500 of each employees salary each year. Web Maryland Payroll Taxes When you think of Maryland income taxes think progressive.

Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad Well file your 1099s new hire reports. Ad Fast Easy Affordable Small Business Payroll By ADP.

Due to changes to the Federal W-4 form in 2020 there are now two versions of the Net Pay Calculator. Your average tax rate is 1167 and your marginal. Make The Switch To ADP.

Customize using your filing. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Ad So Many Options To Easily Run Your Payroll-Compare All terms and prices Top Brands Only.

Web Use our free Maryland paycheck calculator to calculate your net pay or take-home pay by entering your period or yearly income along with the necessary. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Payroll Tax Wikipedia

6528 Clear Drop Court Unit 103 Glen Burnie Md 21060 Compass

How Are Payroll Taxes Calculated State Income Taxes Workest

![]()

Free Maryland Payroll Calculator 2023 Md Tax Rates Onpay

Maryland Paycheck Calculator Adp

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20

Free 7 Payroll Adjustment Forms In Ms Word Pdf Excel

Pdf Sexual Dimorphism Of The Developing Human Brain Judith Rapoport Academia Edu

Maryland Income Tax Calculator Smartasset

Consumption Costing Of Apparels

Maryland Hourly Paycheck Calculator Gusto

3745 Ridge Road Westminster Md 21157 Compass

Free 31 Calculation Forms In Pdf Ms Word

Consumption Costing Of Apparels

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Free 31 Calculation Forms In Pdf Ms Word